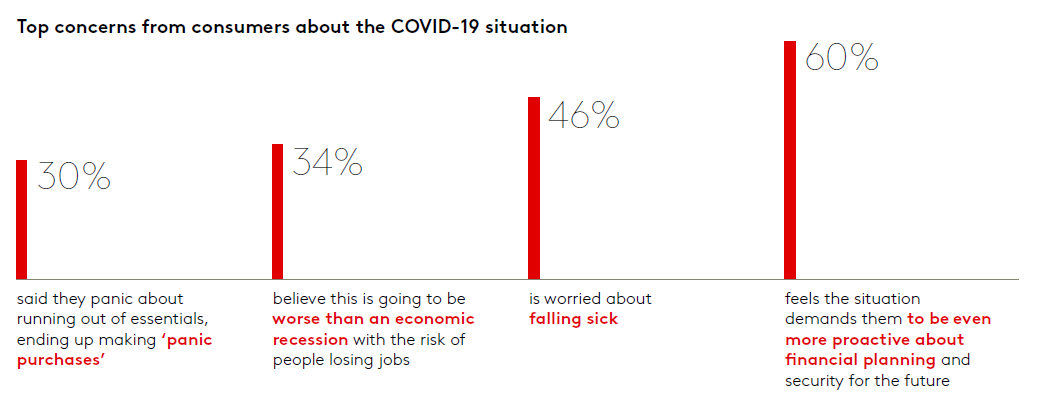

Despite the increasing numbers of cases of COVID-19 across Asia, the top fear is not falling sick but the threat that the virus may hurt individuals’ financial health, according to a recent study* conducted by Kantar. As the global financial markets plummet in what seems to be the worst since the Global Financial Crisis, 60% of people across Asia are worried for their financial security. Followed by 46% who are worried about catching the virus, while the fear of falling sick is highest in Japan (68%). Over a third of Asians (34%) fear COVID-19 could push economies to the brink of recession. Koreans are most concerned about their financial health (77%) and job losses (61%).

Almost half (48%) of consumers in the region are ‘hugely concerned’ about the impact of COVID-19 on their day-to-day lives. Understandably, people living in countries with the highest number of cases are feeling most vulnerable to the virus, with 75% in Korea and 60% in Japan saying that they are concerned, and their lives have been disrupted. The level of trust in the way the government is handling the crisis is very low in Korea (39%) and Japan (9%). In Singapore, where only 33% are concerned, 78% say that they trust in the government’s approach to handling the crisis.

Kantar analysis covering the stock price evolution of over 100 consumer goods companies across Asia shows that only a small group of corporations managed to improve their value since COVID-19 started spreading uncertainty across the region. Consumers and markets are waking up to the economic threat posed by COVID-19, as attested by global stock markets including Asia sinking even deeper.

Travel less, eat in and stream content more

The study shows how people are adjusting their lifestyles to reduce the risk from COVID-19. The industry that has been hardest hit by the outbreak is travel, with 59% of people saying that they have decided to travel less to stay safe. This is followed by 52% saying that they are less likely to eat out, and the same number (52%) saying that they are avoiding socialising outside of the house. Instead, people are choosing to stay in, with 42% streaming more content, 33% hosting get-togethers at home and 30% ordering in food.

Purchase behaviours have also shifted as the threat from the virus has grown. The most apparent development has been the rise in ‘panic purchases’ in many countries, with around one in three (30%) saying that they worry about running out of essentials and buy more than usual, leaving shelves empty. This is highest in Japan where 64% of people admit to this behaviour.

Surge in shopping online, hygiene and health categories

The study also reveals a 32% increase in online shopping across these markets over the past two months as people avoid crowded supermarkets or use e-commerce channels to get their hands on items that are out of stock in physical stores. Koreans have the highest increase in online shopping (41%). Online grocery platforms and food delivery services saw the highest increase, resulting in many providers having to adjust their strategies to deal with the demand. In contrast, shopping in retail outlets has been reduced by 35% over the same period.

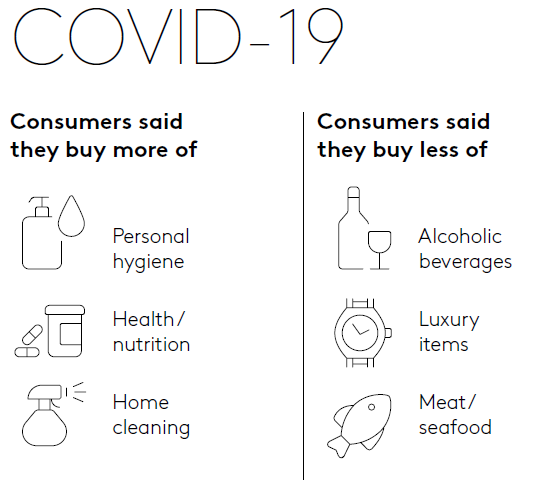

Predictably, categories associated with hygiene and health have seen the biggest rise in purchases, with 48% of people saying they are buying more personal hygiene items such as face masks and hand sanitiser, 45% buying more health and nutritional items such as vitamins to improve immunity, and 40% reporting that they are spending more on home cleaning products. On the other hand, people are spending less on alcoholic beverage (30%), a trend also seen during the SARS epidemic. In addition, fewer people are buying luxury items (27%) and meat and seafood (21%).

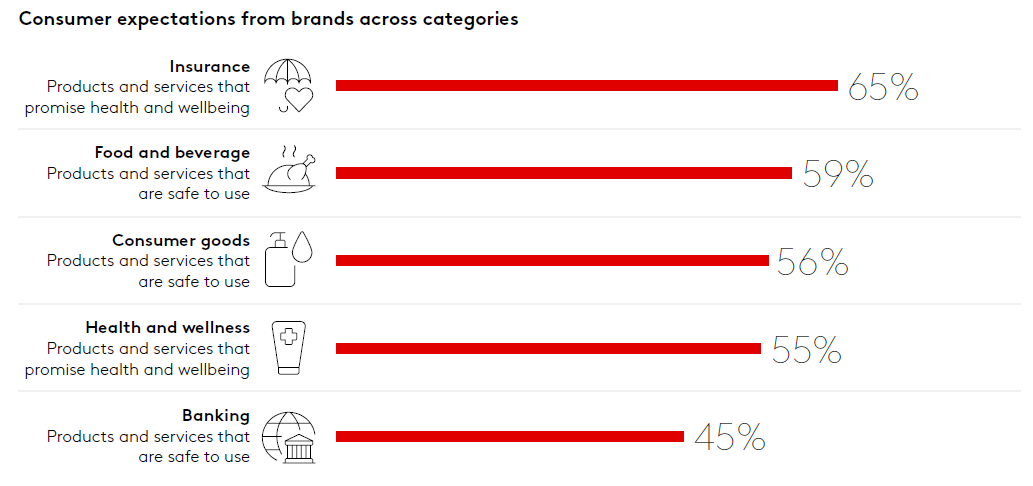

The study also highlights how COVID-19 is resulting in consumers with a heightened focus on products and services that are ‘safe to use’, especially when it comes to the Food and Beverage category and Consumer Goods. In addition, they are looking for brands that have enhanced health and wellbeing benefits to help build a strong defence against the virus. There is also demand for the insurance sector to create more products geared at covering health and wellness in times of crisis.

*This is based on an online survey of 3,000 consumers between the ages of 18 and 60 across six countries in the region: Singapore, Indonesia, Philippines, Korea, Japan and Thailand. Fieldwork was conducted between 25 and 27 February 2020. Kantar’s panel data and social media analysis over the period between 18 Dec and 27 February 2020 complements the survey.

To discuss how we can help you navigate this uncertainty and ‘uncomfortable growth’, connect with Stephane Alpern.

Find out more Kantar resources on the impact of COVID-19 on Chinese consumers here:

- Measuring the impact of the Coronavirus on China’s consumption

- A cross-industry view on the impact of Covid in China

- Chinese public's health awareness and behaviour during epidemic

- How does an epidemic affect consumer purchase behaviour?

- Impact of COVID-19 Outbreak on FMCG Market During CNY

- New opportunities for dairy amid epidemic

- How can beverage brands survive Coronavirus outbreak?

- Conjectures about paper products after the epidemic

- COVID-19’s impact on Vietnam FMCG market